My central thesis in this series is that it is much wiser for investors to focus on the avoidance of losing money, rather than on making extra money in the market. The first thing to say is exactly how not to do this. Which is to say, “whatever you do, don’t follow your gut.” While […]

On the Wisdom of Cowardice

Warren Buffett has so many great quotes. There’s the one about how idiots eventually run good companies. There’s that other one about today’s shade coming from a tree planted long ago. He’s a folksy guy and damned smart, so his quotes are like little Yogi Berra gems without all of the unintentional irony. But of all of his […]

The Chosen One

Before I ever cared about early retirement, before I ever churned my first credit card, before I had ever gone to medical school, or college, or high school, hell, before I even liked girls, before any of this, I loved baseball and the San Francisco Giants. I dressed up in homemade Giants uniforms, sweat pants […]

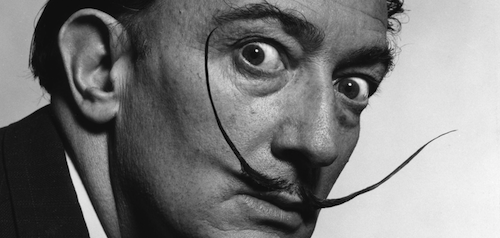

A Most Mustachian Endeavor

It would not be overly dramatic to say that when I first read Mr. Money Mustache’s “shockingly simple” blog post, it was as if I had been hit by a bolt of lightning. The simplicity of the math. The fundamental soundness of the assumptions. And the far-reaching implications of its conclusions were all immediately gripping, […]

Jumping off a Cliff

I feel a little bit like a fundamentalist preacher who woke up one morning and realized he did not believe in God. Or not so much that he didn’t believe in god, more that he found he also believed in a larger, cooler, non Judeo-Christian god. Up until this point I’ve done a pretty decent […]

Bad Companies

I was lucky enough to do my internal medicine internship and residency at the University of Chicago on the southside of Chicago. This was a fantastic training program for a number of reasons. It was a high-powered academic center with ample research power. The residency program directors were humane and resident focused. Education was stressed […]

White Coat Face Off: Mortgaging Your Future?

I’m in the midst of a bit of a call weekend beat down. Nothing terrible, just busy. Pacers, and consults, and pages, and so on. But the show must go on. Early retirement waits for no one. And it seems to me that today is as good a day to continue my pseudo-dialogue with the […]

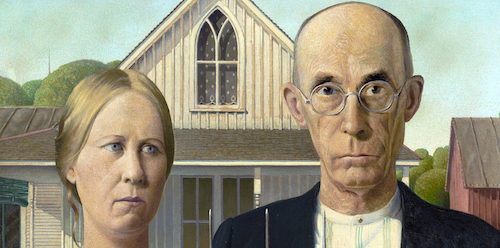

Born to (not) Lose

The field of behavioral economics is an interesting one. One of its central tenets is that there is a so called “behavior gap.” This behavior gap describes how much less individual investors earn, on average when compared to the sum of their investments. And the reason for this behavior gap is that in many ways […]

Out On a Limb

There is something surprisingly useful about broadcasting your own assumptions to other people There is this concept called “what you see is all there is,” (WYSIATI) discussed extensively in Kahneman’s book Thinking Fast And Slow. And the point of WYSIATI is that our minds (particularly our intuitive “system”) are extremely biased towards narrative. So if […]

What I Talk About When I Talk About Bonds

Warning: this will not be a particularly well researched or philosophical post. I’ve read my fair share on the subject I’m about talk about, but I’m certainly no expert. The reason I’m writing this post is just to communicate the simple model that I have in my head when I think and talk about bonds. […]

Recent Comments