The most central message you can glean from my posts on early retirement is that you should save more of your take-home pay.

Why? Because small changes in your spending and savings patterns will work out to dramatic changes in your future financial freedom. Both in terms of time and money.

But if there’s a second most important message, it is this:

Passive investing is a much better bet than active investing.

So it may surprise you that I strongly considered testing out an active investment strategy last week.

It all started when I found CXO advisory by way of a nice interview on Rick Ferri’s blog.

Steve Lecompte performs quantitative analysis on different investment strategies on this site and he publishes his results.

He recommends one of two strategies for long-term success; either invest in a broadly diversified portfolio of passive vehicles and rebalance once a year (sound familiar?) or use a momentum strategy.

In particular the momentum strategy he recommends is to follow the last five months performance of a variety of exchange traded funds and put all of your money in the most successful, or the three most successful funds at the beginning each month.

The impressive thing is that he is publishing it in a prospective fashion. This means that he announced his strategy before hand and now he executes it and reports the results on a monthly basis.

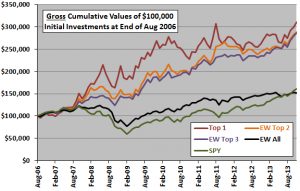

Here are his results:

Pretty impressive if you ask me. Where $100,000 invested in 2006 grows to $150,000 when invested in the S&P 500 (SPY), it grows to over $300,000 when invested in the Top 1 momentum ETF strategy.

The behavior of the portfolio was also impressive during the financial crisis of 2008/09. Note how it loses less of its value through the dip corresponding to The financial crisis. (About a 25% loss in value from prior to the crisis to its nadir when compared to a 50% loss of value of the S&P 500.)

The strategy is intriguing enough that I would like to test it out with, say, $1000 of my own money.

Here’s what is not included in the graph however. The costs of trading.

So imagine I wanted to compare my copyrighted*** MD squared index with this strategy.

Imagine I put a thousand dollars into my MD Squared index and thousand dollars into the momentum strategy on day one (both in motifinvesting.com accounts.)

I will rebalance the MD squared index annually. And I will rebalance the momentum strategy monthly (as in keeping with the strategy.)

Each rebalancing costs $10 with this brokerage firm no matter how many trades required.

Let’s say that on three of the 12 months of the first year, the most momentous stock remains the same so I do not need to rebalance. I will still need to rebalance 9 times.

So I will have $90(9X 10$ or 0.9%) in trading costs with the momentum strategy versus only $10 (0.1%) with the MD squared strategy.

But this is just the beginning of the cost difference.

What if this investment is not in a tax-sheltered account?

Then every rebalancing will result in the sale of an asset held for less than a year. By definition this is a short-term capital gain, which means that each dollar of investment income is taxed at ones highest marginal tax bracket.

This can mean a loss of almost 50 cents of every dollar earned in this investment.

That is a very high hurdle to surpass indeed.

Which I think really drives the crucial point home.

Even clever and well researched ideas are severely handicapped by the additional costs associated with executing them.

So while I still may experiment with this investment strategy, it will only be if I can check both of these boxes:

1. The investment is placed in a tax sheltered account, like a retirement account.

2. The trades are made through a brokerage that allows me at least 12 free trades a year.

I’ll let you know if and when I start this experiment. In the meantime it’s hundred percent passive investment for me a hundred percent of the time.

*** It’s not copyrighted. Feel free to use!