If I were to design a tax system it would be simple and progressive.

The rates would be largely lower than the current rates because there would be no deductions.

Income would defined simply. Any money earned in any manner would be income and there would be no distinction made between money earned by labor, or investment, or inheritance. It would all be taxed at the same rate.

And the rates would start very low and go up from there.

So maybe your first $15,000 would not be taxed at all. But any income over a million dollars a year would be taxed at a high rate. Say 40 to 50%.

That’s my utopian vision. Simple. Fair. Progressive.

People say I’m a dreamer….

But it’s time for me to snap out of it.

In the real world taxes are complex. There are all sorts of incentives that don’t make any obvious sense on a macro or micro-economic level.

Why give tax breaks to homeowners and not to renters?

Why tax earned income, dividends, long, and short term capital gains at different rates?

Why give tax breaks to religions, or even charities?

Why allow off-shoring of profits for tax avoidance purposes?

It’s all so messy, but that’s the world we live in.

And given that, I advocate for tax avoidance by any (honest) means allowed under the law.

(I would even argue that it’s the only rational way for an individual investor to behave.)

Which is a long-winded way of saying that taxes matter to investment performance in the same way that costs matter.

Marginally lowering your taxes on investments over time will have a dramatic impact on the growth of your investments.

So what are some simple rules for tax avoidance?

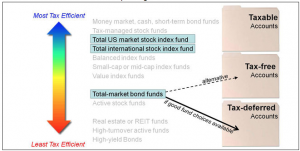

You should preferentially put your most tax efficient investments into your taxable accounts, and your least tax efficient investments in your tax sheltered accounts (IRA’s 401(k)s, Roth IRAs, HSA’s etc.)

What makes some investments more tax efficient than others? In short it’s the different tax rates for different types of income.

Short-term capital gains are taxed as ordinary income. In other words at the rate of whatever your highest marginal tax bracket is.

Dividends are taxed at an intermediate rate (up to 20% for high income earners).

Long-term capital gains taxes can be as low as 0% if you are in the 15% tax bracket or less, but can go as high as 23.8%, under current law, for couples making over $450,000 a year.

So what does this mean practically in terms of where you put your investments?

Here is a list of investment classes from most to least tax efficient taken from the the excellent Bogleheads wiki on the subject.

The lower on the list the class is, the more you should try to avoid holding it in a taxable account.

click to enlarge

So summarizing, in terms of taxes: dividends (REIT/value strategy funds), and trading (active funds), are bad. And foreign stock funds can have some tax breaks associated with them.

It’s also worth mentioning that, in general, exchange traded funds are more tax efficient than mutual funds. And some funds are designed with tax efficiency in mind. (They incorporate strategies to avoid unnecessary trading, and capital gains losses into the fund design.)

It’s also worth mentioning that the best way to avoid capital gains in your taxable accounts is never to sell funds if you can avoid it. So one should rebalance as infrequently as possible, and do it by buying under-weighted parts of the portfolio not by selling overweighted portions.

There is also a nice little sneaky trick called tax loss harvesting.

But I’m saving that topic for a future post. Stay tuned.

(You’re interested aren’t you? You should be ashamed of yourself.)