There are no free lunches in investing.

The only possible exceptions to this axiom are diversification, and value investing, both of which have the potential to increase portfolio returns relative to risk.

Aside from these exceptions, however, risks and returns are inextricably linked.

If you want higher returns, you must accept the higher risk of loss.

I think that most people’s first response when faced with this observation is to overestimate their tolerance for risk because they want higher returns.

This was certainly the case with me.

But it probably makes sense to move beyond this first reaction and spend some time focusing on the risk side of the equation, rather than the rewards.

In Larry Swedroe’s excellent book, The Only Guide To To A Winning Investment Strategy You’ll Ever Need, he focuses on three factors related to risk tolerance; The need to take risk, The ability to take risk, and the stomach acid test.

In my view, the need to take risk is the most important factor to consider.

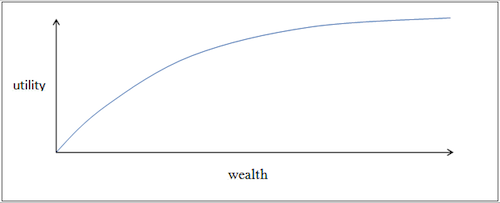

Central to this concept is the idea of “the marginal utility of wealth.”

This is an economics concept, that states that although more wealth is always a desirable thing, there is a certain point, past which additional wealth brings ever diminishing amounts of additional utility (happiness.)

Apparently to economists “utility” = “happiness”

Apparently to economists “utility” = “happiness”

More importantly, once you’ve gotten past that point, The downside of losing your money is much greater than the upside of accumulating more money.

This dovetails nicely with the concept of knowing your number. If you don’t know when you’ve reached financial independence, it is likely that your portfolio risk profile will remain overly aggressive once you’ve achieved your savings target, putting your very financial independence at risk.

Swedroe gives a framework where your required rate of return from your nest egg is tied to your equity allocation.

So if you can live on a rate of return of 2% or less of your portfolio, you should have 100% of your money invested in fixed income (bonds.) Limited upside, Little risk.

But if you require a 9% return from your portfolio, you need 100% of your portfolio invested in equity ( stocks,) volatility and risk be damned. Increased upside, very risky.

The ability to take risk refers to real life factors that impact a person’s financial loss tolerance.

The most important factor to consider here is one’s investment horizon (The number of years until retirement.)

If you’re planning on retiring in 30 years and your investment portfolio takes a temporary hit of 50% in its value, this impacts your current and future lifestyle in no meaningful way.

If on the other hand if you’re retiring in two years and your nest egg takes a 50% hit, that is extremely damaging. Your choice is either to continue working, or to face a 50% drop in your investment income during retirement.

The other factors that affect your ability to take risk are the stability of your job, and your need for near-term cash (liquidity).

The final aspect to determine your appetite for risk, and thus the make up of your portfolio is the so-called stomach acid test.

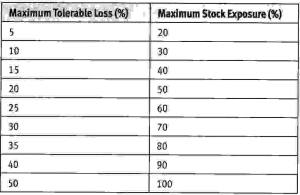

This starts with a pretty simple table that matches your maximum tolerated loss to the maximum equity percentage of your portfolio.

But if you’re like me, when you first look at this chart you’ll think something along the lines of, “no risk no reward, I could handle a 50% loss of my portfolio.”

This is why people tend to overestimate their risk tolerance.

So do me a favor, play an imagination game with me.

Imagine you’ve been putting money into a portfolio for the past 20 years through thick and thin.

You’ve watched the stocks go up and down but there’s been a nice steady growth over time. You now have $1 million invested.

Then the financial crisis happens.

You lose 5% of your portfolio ($50,000) on the first day of the crisis.

Over the next two years the market is volatile but it’s overall direction is persistently downward.

At the end of year one, you’ve lost 25% of your portfolios value in slow motion. You now have $750,000 in the account.

And guess what, it’s time to rebalance. So now you’ve got to pull thousands of dollars out of your stable bonds and pour them into the very stocks that of lost you one quarter of your retirement savings.

Another year passes. Day after day news reports tell you about the dire state of the economy. Financial experts doubt the future of many of the asset classes that you’re currently invested in. Your stocks continue to lose value.

Some of your close friends and family have probably been laid off. Fortunately you have not.

But you’ve now lost 50% of the peak value of your retirement assets.

And you know what time it is. It’s time to rebalance.

If you cannot imagine yourself selling bonds at that moment and purchasing more of the tanking stocks, then you can not tolerate a 50% loss in your portfolio.

And the outsized performance of stocks over bonds, and stock heavy portfolios over fixed income portfolios depends entirely on you being able to stick to your allocation through thick and thin.

Otherwise when the going gets tough, you will flee to safety, ensuring that your losses are locked in. You will have essentially bought risk, and sold return.

So it probably makes sense to ask yourself the hard questions now, to be true to yourself, and to err on the side of saving more, and investing in a slightly less risky portfolio then you honestly think you can handle.

PS Believe it or not the title image of this post is a drawing, not a photo, for more amazing realistic works see this link….