I realize that just because investing is deeply interesting to me, doesn’t mean that it’s interesting to everyone else.

Some people read investment theory books for breakfast lunch and dinner (i.e. me). But others’ eyes roll back at the mere mention of “compound interest.”

Allocation? Don’t talk to me about allocation.

I would argue , however, that even people who are not interested in investing, per se, would benefit from a solid and well executed investment plan.

After all, most people value their own free time. Most people enjoy having money to spend. And most people don’t want to work forever.

So if you have no interest in investing, but still want to retire at some point, What approach should you take?

Well it’s the same approach as for someone who finds financial planning terribly interesting:

Save more, invest in a well diversified, low-cost, portfolio of index funds, and rebalance your portfolio regularly.

And what is the best way to do this?

If you don’t want to come up with your own investment plan or rebalance yourself, then I would argue that the best approach would be to use Betterment.

Betterment is an online investment product with several unique features.

1. The Investor can determine how aggressive his or her portfolio should be and allocate his funds to a fixed percentage of bonds and stocks based on this determination.

2. Betterment then reinvests all subsequent contributions, dividends, and interest income in such a way that it passively rebalances the portfolio while minimizing trading and tax costs.

3. If any one asset class within the portfolio gets more than 5% out of target range, betterment automatically rebalances the portfolio with the sale and purchase of shares. The investor is required to do nothing. This is truly a “set it and forget it” product. Just put your money in and it is automatically continually reinvested and rebalanced within a well diversified, well-designed, well balanced, low-cost portfolio.

4. Betterment is a fee-only platform. The percentage of your portfolio that is lost to fees is between 0.15% and 0.35% depending on how much money you have invested, plus the expense ratios of the ETFs. The ETFs invested in the betterment portfolio all have expense ratios of less than 0.5%, with most much less than 0.5%. This does qualify as a low-cost product in my book.

5. The interface is very slick. More importantly it is very transparent. Betterment is the only product that I have seen including Fidelity and Vanguard, which shows you exactly how much money you have invested, exactly how much money you have made, and what your percentage return on investment is each time you look at the account. Most investment banks make this data very opaque so it is difficult for the consumer to see what the actual return on investment is.

So what are the downsides?

1. It is kind of a one-size-fits-all model. You cannot customize your portfolio as you could within a generic brokerage house account.

2. Since you cannot sell individual funds within the betterment account in isolation, it is very difficult to participate in tax loss harvesting. (A topic for another day.)

3. It is slightly more expensive than opening up a Vanguard account and rebalancing your portfolio yourself every so often.

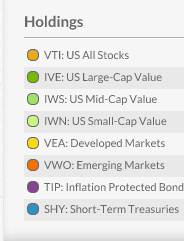

So let’s look at the betterment portfolio. This is a screenshot taken from my betterment account.

VTI: this is a very cheap total US market ETF. (Low-cost large-cap blend: check)

IVE: this is a large cap value fund. (Value premium: check)

IWS: this is a mid cap value fund (value premium: check)

IWN: this is a small cap value fund. (Size premium, value premium: check, check)

VEA: Foreign developed markets. (foreign diversification: check)

VWO: foreign emerging markets. (emerging markets exposure: check)

TIP: low-cost treasury inflation protected bond fund. (Low risk bonds: check)

SHY: low-cost short-term US treasuries Bond fund. (Low risk bonds: check)

So this portfolio pretty much hits all of its spots. It is tilted towards both the size factor, as well as the value factor, which both have increased expected returns.

It is also well diversified which should increase the efficiency of the portfolio.

If I were designing my own portfolio it might look somewhat different. (I might have some exposure to real estate. I might select different individual ETFs from each class, and include the momentum factor in the portfolio.) But as a whole this is a very solid, well diversified low-cost portfolio.

And due to the automatic rebalancing, this is a fund that you can put your money in and get on with your life, without any ill effects.

As a disclosure, I do currently use betterment for my own taxable investment accounts. I have also advocated for both of my parents to do the same, and they have.

But at the time of this writing, I receive no financial benefit for advocating for betterment.

I simply believe it to be a good product.

But do your own due diligence, after all I’m only a doctor.

If you do decide to invest with betterment feel free to click on the below link; you will get 25$ and I will get 10$, deposited into our betterment accounts. (But search for any better deals on the net before committing to this please.)