My love affair with Japan probably started before birth. I say this because my parents are Japanophiles. So much so that growing up my father actually studied Japanese tea ceremony. (I was more than a little embarrassed once or twice as a boy when my friends would sleep over and catch glimpses of my dad […]

Born to (not) Lose

The field of behavioral economics is an interesting one. One of its central tenets is that there is a so called “behavior gap.” This behavior gap describes how much less individual investors earn, on average when compared to the sum of their investments. And the reason for this behavior gap is that in many ways […]

Out On a Limb

There is something surprisingly useful about broadcasting your own assumptions to other people There is this concept called “what you see is all there is,” (WYSIATI) discussed extensively in Kahneman’s book Thinking Fast And Slow. And the point of WYSIATI is that our minds (particularly our intuitive “system”) are extremely biased towards narrative. So if […]

What I Talk About When I Talk About Bonds

Warning: this will not be a particularly well researched or philosophical post. I’ve read my fair share on the subject I’m about talk about, but I’m certainly no expert. The reason I’m writing this post is just to communicate the simple model that I have in my head when I think and talk about bonds. […]

Diversions

Smart investing is boring, plain-vanilla, milquetoast. One need only invest in well diversified portfolio of low-cost, passive index stock funds, and just enough bonds to match their own risk tolerance. (And rebalance once every year or two.) And yet here I am several hundred posts into my blog, still writing about investing. And the reason […]

Stupid Human Tricks

I’ve tried to be pretty Orthodox in my investment writing here, to date. I think that most of what I write about investing could be successfully boiled down to a pretty boring list of 10 plain vanilla commandments. Save more of your own money and invest it. Invest your money in low cost passively managed […]

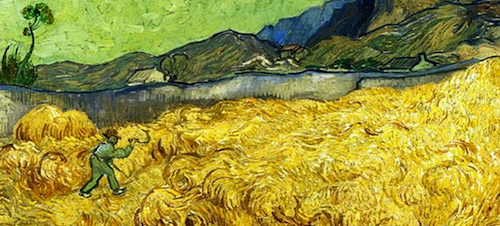

Harvesting Value

One of the best things about not having advertising on my blog, is that I feel completely comfortable making recommendations. There’s no money being made here. There’s no conflict of interest. And while my opinion may be flawed, it is certainly not corrupt. It’s no secret that I think that Betterment is an excellent investment […]

There is no Monster Under Your Bed

One of the most interesting aspects of fear is that it is often completely irrational. Which is not to say that fear is unnecessary, or even not useful. It’s just that it seems to reside in the deeper less evolved parts of our brains. It’s a more animal, and a less analytical response to the […]

K.I.S.S.

Having had the good fortune to complete high school, an undergraduate degree, four years of medical school, three years of internship/residency, three years of a cardiology fellowship, and one year of a subspecialty fellowship in arrhythmia, I’ve been blessed with the opportunity to learn from a lot of teachers. And when I look back at […]

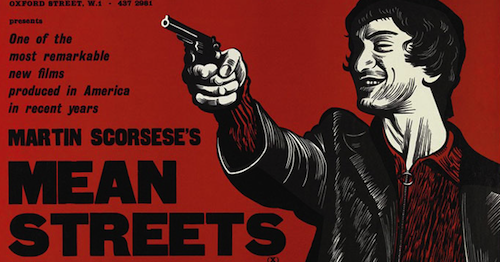

Mean Streets

If you’re looking for a North star to guide you on your investing journey, you could do a lot worse than to set your course by John Bogle. If the prevailing ethic that guides Wall Street is to “sell the sizzle and not the steak,” meaning to appeal to people’s fears and greed to sell […]

Recent Comments