One of the most interesting aspects of fear is that it is often completely irrational.

Which is not to say that fear is unnecessary, or even not useful. It’s just that it seems to reside in the deeper less evolved parts of our brains. It’s a more animal, and a less analytical response to the external environment.

And one of the important things to remember about fear, is that it’s subconscious, illogical core often prevents us from making smart decisions.

And this is the point that Karen Thompson makes in her excellent TED talk when she proposes the concept that fear is simply a story that we tell to ourselves.

If fear is a story, and we are the audience, then our response is logically going to be proportional to the drama and excitement that the story inspires. More importantly our response will often not be at all proportional to the actual risk of the danger described in the story itself.

An example: gun violence. Particularly mass shootings.

Thinking about events like the Newtown shooting, or the recent tragic shooting spree in Santa Barbara, we generate images in our minds eye of innocents shot. We immediately and involuntarily summon up the pain of families torn apart and forever broken. Images and emotion bubble violently in our minds eye. We focus our attention. We become obsessed.

But what about when we think about heart attacks?

I’m a cardiologist, and when I think about a heart attack, the image that is summoned in my mind is that of a plump 50-year-old businessman who is a little bit sweaty, and complaining of some indigestion-like chest pain.

I consider this image, think to myself “that would suck,” and finish eating my cheeseburger.

You see where I’m going with this don’t you?

There are about 10,000 gun related homicides in America per year. And this is one of the most gun violence prone countries around.

Compare that to the 600,000 heart disease-related deaths here in America each year.

So you’re 60 times more likely to die of a heart attack than you are to die at the hands of someone else bearing a gun.

So logically what should you be more afraid of? What should you spend your time trying to prevent? Being shot or having a heart attack?

The point here is not that we shouldn’t fight for fewer guns. We should. Gun violence is preventable and tragic so we should try to eliminate it.

But we probably shouldn’t waste so much our time worrying about gun violence, plane crashes, and kidnappers preying upon our kids. Odds are that they won’t.

Just because the picture in our mind is gruesome, doesn’t mean that the event that it depicts is probable.

But our fear is irrational, and so our sense of risk is irrational.

And this animal fear spills over into every aspect of our lives including our investment choices.

Which brings me to the irrational fears of investing.

There are many things that prevent us from making smart financial decisions; poor spending habits, inadequate income, external events that we can’t control, but one of the biggest factors, I think, is the accumulation of unspoken fears.

So why not air them out and explore their validity one by one?

Fear #1: I’m afraid of losing my money in the market.

While this fear is rational for short-term investments, it is not so rational for long-term investments.

Over long time horizons, the stock market has always returned value in proportion to its risk.

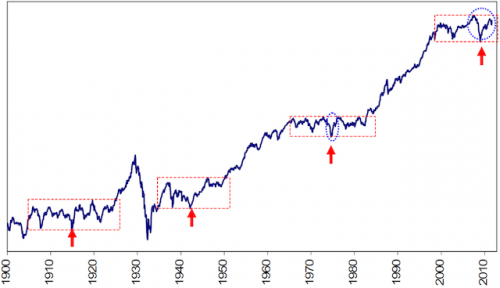

Let’s look at this graph for the historical performance of the Dow Jones industrial average.

There were certainly times when you could have lost an awful lot of money quickly, but if you had simply bought-and-held, the trajectory was a pretty consistent (and generous) slope upward.

Now don’t get me wrong, there is still risk. And there’s no reason why the market could not go down and stay down for a long time, improbable as that outcome would be.

But what kind of an event would it have to be for all of the wealth in the world economy to evaporate and for governments to do nothing about it? And if such an event were to occur, wouldn’t retirement planning be the least of your concerns? Wouldn’t you be more preoccupied with finding potable water, food, and shelter for your family?

Compare this risk to the risk of not investing your money in your own retirement. If you simply stash your money under your mattress or put it in a low interest bank account, there’s a near certainty that the value of your money will be eroded by inflation. Your money will be constantly shrinking, instead of generally growing. And the amount you’d have to save for retirement would become prohibitive. This means there’s a near certainty that you would be poor in retirement.

Inflation isn’t particularly scary, (like the collapse of the world economy,) but it is very much more likely to hurt you in your lifetime.

And the probability is that you will be economically better off spending your time worrying about near certainties rather than planning for vanishing (though scary) eventualities.

Nuclear fallout shelters: seldom good investments, if goal is to build wealth.

Fear #2: I am afraid of being conned.

You have no doubt heard about the recent book penned by the talented Michael Lewis, Flashboys.

I have yet to read this book, though I will. But it reportedly tells the story of high-frequency trading and how clever practitioners have used lightning fast computers and hardware to game the system to make quick money on large transactions by beating institutional investor’s buy and sell orders to the stock exchange.

And the message is clear. Clever Wall Street types are cheating at the expense of the rest of the market (a.k.a. you and me.)

And you’ve also no doubt heard about Bernie Madoff, who ruined many retirements and endowments with his Ponzi scheme.

And again, the message seems to be clear: the playing field ain’t level. Ergo retail investors are doomed to become prey to these predators.

But who has ever been victimized by buying plain-vanilla index funds? And if you buy every share that you purchase for an extra 25th of a cent because of high-frequency trading, how much of an effect do you think that this will have on your future retirement nest egg?

I would argue that high-frequency trading will have almost no effect on your wealth at all. And I would further argue that your chance of being taken to the cleaners by a Bernie Madoff type is next to zero if you just “keep it simple sweetie:” Buy cheap funds and hold them. And don’t try to hit homeruns.

Fear number three: I’m afraid that now is the wrong time to get into the market.

This one is understandable, but wrong nonetheless.

With the Dow and the S&P 500 at record highs it’s easy to see how someone could be gunshy about dumping their savings into the market right now.

But before the prospective investor gives into this fear, there are some important facts that should not be ignored.

- Not investing at this point because the market seems expensive is a form of active investment. And all evidence suggests that active investment is a losers strategy.

- You have no idea when the market will go down, and neither do I.

- The market tends to go up over time, particularly long stretches of time.

- The right time to invest your money is usually now. And though you may feel like second guessing your decision after-the-fact, short of insider information there is no way to really know if the market is going to go up or down in the near future.

- It would’ve been logical for someone to make the argument that the market was overvalued last year as well. And had someone pulled their money out of the market at the start of 2013, they would’ve missed out on a 25% gain in the S&P 500 last year.

So the take-home messages should be clear.

Heart attacks are more likely to kill you than gun violence (even though mass shootings are much scarier.)

And not investing is much more dangerous to your future financial health than investing (even though investing will always feel more risky.)

Please share your past and present investing fears below…

26 Responses to “There is no Monster Under Your Bed”