As we discussed in The Miles Game one of the prerequisites for getting into the game at all is tracking and maintaining a good credit score. But how does one go about doing this?

Well, the first thing to do is to get a free copy of your FAKO scores.

Credit Sesame and Credit Karma give you instant and ongoing access to a good approximation of your actual credit score from two of the big three credit reporting agencies.

I’ve compared them side-by-side with true Fico scores on several occasions, and they’ve always been plus or Minus 10 points of the real deal.

But what will happen to your credit score if you get into the miles game. Will the churning of credit cards Destroy your all-important credit score?

The short answer is, no, over time your credit score should remain the same or even improve. But in the short-term you likely will see a dip in your credit score.

This is why if you have a big loan application upcoming, now is not the right time for you to embark on The Miles Game.

To understand why the long-term impact of credit card churning is positive but the short term is negative, let’s look at the factors Contribute to your credit score.

LOW IMPACT FACTORS

1. Total accounts: The more the better. The fact that multiple creditors give you accounts means that you are credit worthy in the creditors eyes. Obviously as your pile of credit cards thickens your grade will get better in this category. (Verdict: Yay)

2. Credit inquiries: The more the worse. When you apply for six credit cards in one day, Your behavior makes you look a bit like Nicholas Cage in Leaving Las Vegas. “More credit cards equals more whiskey. ” You just don’t give a damn. It is estimated that each hard inquiry on your credit report costs you 5 to 7 points on your credit score. Fortunately this phenomenon is short-lived. With minimal effect on your credit score after 2 to 3 months. (Verdict: Boo.)

I’ve got a pocket full of credit cards!

MEDIUM IMPACT FACTORS

1. Age of credit history. (It’s going down.) Each time you apply for and get six credit cards, You’ve added six credit cards with the age of zero to your credit history. As you might imagine your credit history’s Age can shrink pretty quickly. The longer you’re in this game, the less this effect will be. But make no mistake on this front; you’ll take a step backwards. (Verdict: Boo)

HIGH IMPACT FACTORS

1. Derogatory marks: The worst thing you can do for your credit score is to not pay your bills on time, to default on a loan, or to declare bankruptcy. But you’re never going to be late on a credit card payment, you will keep track of your cards, and pay off your bills as soon as they arrive. Right? (Verdict: Ambivalence.)

2. Credit card utilization: This is the one that makes everything alright. You see, creditors want you to use a bit, but not much of your credit line. This is where you look very unlike Nicholas Cage drunkenly stumbling through a casino. You look more like a Vanderbilt, lots of assets, and not many needs. You see, each credit line you get adds to the denominator in the golden fraction that determines credit card utilization:

CREDIT CARD DEBT

CREDIT CARD LIMIT

Fortunately the numerator really never changes. You’re just buying all the things you used to buy but with a lot more credit in reserve. (Verdict:Woo-flippin-hoo!)

You really shouldn’t take my word for any of this. After all, I’m only a doctor… not a credit analyst.

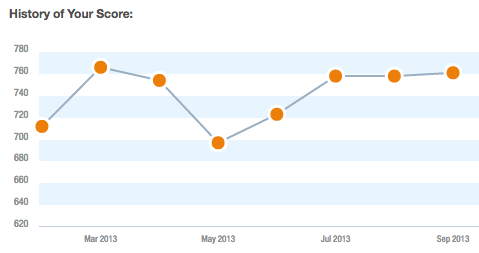

But if you’re curious, here’s what my credit score looks like through a couple of six-credit-card churns In March, and late August.

3 Responses to “What’s the score?”