This may surprise you, but I have not always been money obsessed.

In fact, if you ask my mother what I was like when I was a boy, she’ll tell you that every year for my birthday I asked for the same sort of thing, be it a football, a baseball, or a soccer ball , or a baseball glove. I just didn’t collect stuff.

I also wasn’t one to display an early entrepreneurial spirit, selling lemonade or baseball cards or anything like that.

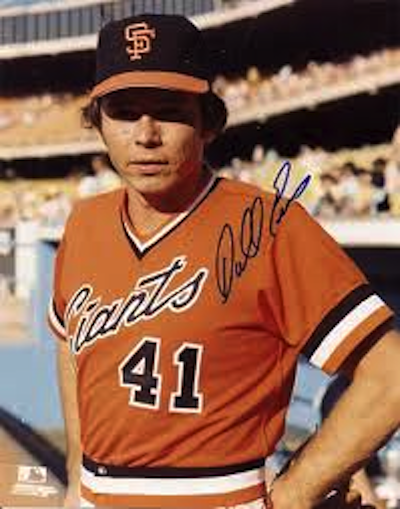

I mostly just obsessed about playing baseball and chocolate bars and skiing and movies and Giants third basemen who could drive runs in.

What I thought about before I thought about money

The point here is that although I have very strong opinions now about financial planning, investing, tax avoidance and the like, it wasn’t always so.

In fact at one point after going into practice, my wife and I did see a financial advisor.

And it was the right thing for us to do at the time.

We wanted to talk to someone who could give us a holistic approach to achieving financial goals like retirement, financing for our children’s education, and financing our house.

And we saw someone and he gave us useful information and it was worth it.

Now my perspective is somewhat different.

My basic perspective now is this.

No one will ever care as much about your money as you do.

And there’s a wealth of useful information out there for you to gather.

So if you’re willing to put in the time I would recommend spending your time reading in the blogosphere, looking at forums like bogleheads.org, and reading some good investment books.

But if you do decide that you do feel more comfortable seeing an expert, then there are some very important concepts for you to be aware of before selecting your advisor.

This is an excellent article from the New York Times for you to take a look at :

How to pick a financial advisor.

I think the main points are these:

1. You should pick a fee-only financial advisor.

With these sorts of advisers you simply pay them for their time.

Maybe they charge $200 an hour, and for that they give you a comprehensive financial plan specific to your situation, and charge you for the hours they work.

They get no commissions. They have no conflict of interest. They simply give you advice based on their own expertise.

2. You should pick a financial advisor who is kept to a fiduciary standard.

Simply ask any prospective advisor, “Are you a fiduciary?”

Being a fiduciary means that they agree to always put your financial interests first. If they do not agree to keep to this standard then they’re only agreeing to give you “defensible” advice. This is quite simply not good enough.

3. Be careful using fee-only advisors who charge you a percentage of your investment. As your nest egg grows, this yearly amount can become substantial and can be a real drag on your portfolio.

4. Avoid commission based financial advisors. There is the real potential for a conflict of interest here. They will have incentive to sell you the products that give them the highest commissions, not necessarily those that give you the highest return and lowest expenses.

5. You should be especially aware of danger signs suggestive of a conflict of interest. These include :

– The adviser only recommends investment products furnished by his own firm.

-The advisor recommends you put annuities (particularly variable annuities ) into tax-deferred accounts such as IRAs or 401(k)s. (In my opinion it’s probably a good idea to steer clear of variable annuities altogether but that’s an opinion for another day.)

-The advisor chooses only to talk about investment products, not about other financial planning decisions unrelated to his own bottom line.

6. The above article includes some helpful links for locating fee only financial advisors. Click on the link for these.

But what if you want to do it yourself? As I mentioned above, this is probably the best option if you’re willing to put in a little work.

If you decide to go this route allow me put together a loose framework for you to set up your own financial plan. (But just remember I’m only a doctor.)

These are some of the questions that you should answer in formulating your own plan.

1. How much risk are you comfortable taking in your investments?

2. How much risk does it make sense for you to take at this point in your life?

(If you’re nearing your retirement goal, it might make sense to take less risk than you’re comfortable with. ((Because at this point the downside of loss is more harmful than the upside of gain is beneficial.))

3. How much term life insurance should you carry?

(My feeling on this one is that if you have a family, or dependents, you should insure up to “Your number” until you’ve reached your number. Your number minus your net worth is also defensible. )

4. Do you need disability insurance?

(You probably do if you are a high income earner early in your career without much net worth.)

5. Should you be saving for your kids college?

(At the minimum you should be saving up to the state income tax-sheltered amount in a 529 if you can afford it.)

Why 529s? Because Bubbles, you might wanna go back to school.

Why 529s? Because Bubbles, you might wanna go back to school.

6. Are you taking advantage of all of the tax sheltered investment opportunities available to you?

(ie 401(k)/403B, Roth IRA or backdoor Roth IRA, healthcare savings accounts…)

7. Have you filled out a will?

(This is an important one even if you are young and healthy.)

8. Have you made sure your expense ratios are low in all of your investment funds?

(The right answer here is “yes.” If you’re not sure check out this post on keeping track of your investments.)

9. And the most important question? What is your savings percentage? The relationship of your savings percentage to your date of reaching financial independence should be your Northstar. Follow it faithfully, and you will likely do well.

It is said that you get what you pay for.

But my feeling is that when it comes to financial planning quite the opposite is true. In this case:

You get what you don’t pay for.

2 Responses to “What You Pay For…”