The unified field theory of early retirement is an elusive ideal yet to be described.

Much like the unified field theory of physics, first imagined by Albert Einstein as a way to reconcile the behavior of small particles, the behavior of large bodies, space, time, electromagnetism, etc. under a single physical set of laws, The unified field theory of early retirement attempts to reconcile all of the diverse motivations of a simple shlub like me, that subconsciously push him towards a more sustainable and better way of living.

The first law of early retirement: S=1/FI. (Spending is inversely related to financial independence.)

Also called the fundamental law of financial independence, this key concept was first widely disseminated by early Financial physicist, Mr. Money Mustache.

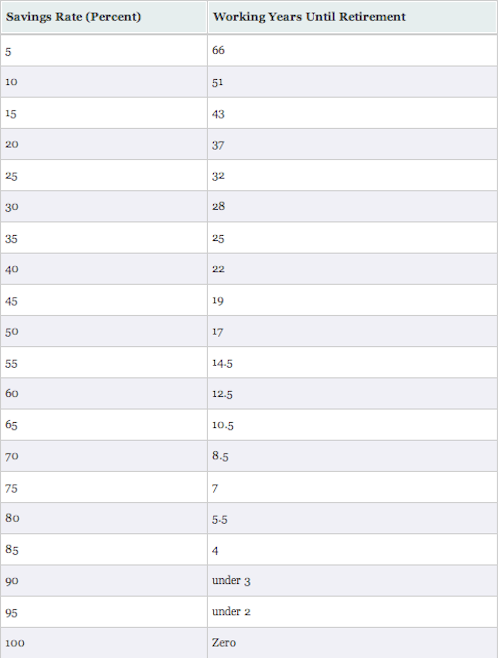

This concept is best described with this simple chart.

s = 1/FI

What the chart shows is that savings percentage (The percentage of take-home pay saved) is the principle variable that affects the time horizon to retirement. The more you save, the shorter your time to financial independence.

On a psychological level this law makes clear that money spent now is not simply money spent. Money spent now is actually financial freedom deferred. It’s an IOU for your own time.

Is a daily coffee at Starbucks actually worth two years of retirement for a teacher? If not, then the first law tells us that it’s probably time for our teacher to get a coffee maker (on craigslist!).

The message is clear. If money spent now will not bring more happiness than freedom from the need to work, then the money is better not spent at all.

Translation: spend less, save more.

The second law of Financial independence: CS </= DS/2 (money spent now is worth at most 1/2 the value of money saved and invested for 10 years.)

Also known as the exponential function of delayed gratification, this concept was first proven by the brilliant mathematician Mad Fientist.

This law exposed why the unnecessary real time spending of money is a sucker’s bet. Current money is deflated by taxes and untouched by compound interest.

Money saved and invested, however overcomes the loss to taxation and then some.

And untaxed money (ie 401k/IRA investments) saved and invested is better by a longshot.

And untaxed money, matched by your employer, and saved and invested is better yet still.

And the message is clear: if you can put off spending to invest, you will get much more value out of each dollar spent.

Translation: Spend less, save more, invest your savings, and take advantage of tax advantaged investment whenever possible.

The third law of financial independence: RSd=1/RDt. (Retirement spending discipline is inversely related to the taxation of retirement dollars.)

Also known as the law of spending disciipline inertia, this insight was first described by the traveling sages, Jeremy and Winnie of Go Curry Cracker, the third law exposes The surprising fact that if spending discipline is continued into early retirement, it is possible to further inflate your already appreciated investment dollars by completely avoiding all earned income/investment income taxes.

And the message is clear: once you arrive at financial independence, you should keep on going with what got you there.

Translation: Spend less, save more, invest your savings, take advantage of tax advantaged investment whenever possible, and once you arrive at early retirement keep your pedal to the metal, change nothing, continue to spend with discipline and invest.

Could that last paragraph be described as the unified field theory of early retirement itself?

You be the judge.

But before you do consider this. Where is the wisdom of travel hacking and manufactured spend ?

Surely this must be included in any unified theory of early retirement.

It appears that our work is not yet done.

2 Responses to “Unified Field Theory”