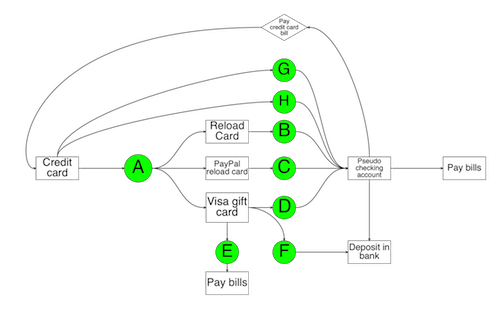

To start the glorious chain of events that results in manufactured spending, begin with the mundane.

It all starts with “A”

We simply take our new credit card to a store (or online) and buy a Visa gift card (Or a reload card, or a PayPal card, but we will discuss those products on another day.)

Why a Visa gift card? Well, sometimes it can be a MasterCard gift card, But in general it should not be an American Express gift card*. This is because by law, any card with a Visa or MasterCard logo (but not an American Express logo) must be able to accommodate a PIN number. And PIN numbers are required in order to reload prepaid cards later. (Don’t worry we’ll get there.)

Visa cards are slightly preferred over MasterCards based on anecdotal reports of difficulty using MasterCard gift cards to reload prepaid cards at Walmart. But this is more of a preference, all things being equal, than a law.

In any case buying Visa gift cards using a credit card is hardly rocket science.

But what is simple is not always easy.

And here are some of the roadblocks that you may encounter on this first simple step of your journey.

Hardwired cash registers.

Sometimes you simply will not be able to buy some gift cards at some stores as the checkout system is programmed not to allow credit card purchases of gift cards. (Personally, I have often had good luck at RiteAid, Walgreens, major grocery stores, and online gift card retailers, but it’s an ongoing trial and error process.)

Suspicious check out personnel

Some employees are suspicious of multi thousand dollar purchases of gift cards (which I get**.)

How you will appear to some checkout clerks…

My usual policy is just to be honest and pleasant and act like I have nothing to hide (because I don’t.) But for some people the social discomfort of navigating such a dynamic can be too much. For those sensitive souls, I would recommend purchasing gift cards online.

Dealing with shipping, insurance etc.

When you purchase gift cards online, there is a significant delay between purchase and actually receiving the card. This is somewhat less efficient than simply walking out of a store with plasticized cash. Furthermore,there is always the risk of the card getting lost in the mail, so you must sometimes pay extra for insurance, deal with Postal Service hassles etc.

But there’s not too much more to securing gift cards than those minor inconveniences. And the rewards of buying cash equivalents are significant.

When you first start browsing gift cards, you will find a dizzying array of choices. Which raises the question; which cards should you buy?

When choosing a gift card the main factors that I consider are the fees to activate the card, whether or not I can set the pin on first use (as opposed to having to call a phone number to set the pin), and whether or not it can later be used for my intended purpose (ie Walmart reloads, evolvemoney, moneyorders, etc….)

Some of the Visa cards that I have personally purchased are itemized below. These represent only my own anecdotal experience. This is not an exhaustive list, and I make no claims about the validity of these descriptions, other than to say that they are described in good faith and honesty. Please doublecheck my facts. As always, Buyer (reader) beware!***

Vanilla gift card, Vanilla Visa, Onevanilla

Fee: $4.95

PIN: set on the first use

What I now use them for: evolvemoney bill pay, money order purchases.

Limitations: Reportedly Walmart registers are now hardcoded not to allow you to reload your Serve/Bluebird card with any vanilla gift cards, so if Walmart is your plan, avoid Vanilla!

US Bank Visa gift card

Looks like this (only its a Visa, not MasterCard)

Fee: $5.95

PIN: Call in to set.

What I use them for: these are ubiquitous in grocery stores. Supermarket purchases can be geographically convenient, or economically useful when it comes to fuel rewards.

Some details worth remembering when you do pull the trigger to purchase your gift cards are to always keep your receipts, (at least until you liquidate the cards.)

My habit is to wrap the receipt around the gift cards that I have purchased and to file it all away once I have liquidated the card.

The reason is that at some point you will buy a gift card and it will fail to activate.

When this happens, you may be faced with the possibility of losing thousands of dollars (an unpleasant prospect, to say the least.)

But in my experience I have never lost any money manufacturing spend. The worst outcome has merely been being unable to access my cash for a few weeks or so, and having to deal with crappy gift card company customer service on the phone. But in the end, armed with my receipts it has all turned out okay (thus far.)

And the best part is that once you’ve made your purchase you’re that much closer to hitting your lofty Credit card spending bonus, which will net you thousands of dollars worth of free travel.

One concern that always comes up is whether or not buying gift cards constitutes a cash advance. To date I have never been charged a cash advance fee for such a purchase. My guess is that it is unlikely I ever will. As it stands now, a $1000 purchase of giftcards at a drugstore simply looks to the credit card company like a thousand dollar purchase of something at a drugstore. While they may know where you shop, and how much you spent, they currently have no way of knowing what you bought. Frankly, I’m not sure they will ever have that ability as it would constitute a significant invasion of consumer privacy. But who knows?

In any case you are already aware that it is always a good idea to set your cash advance limit to zero when you activate your credit cards,which pretty much eliminates the risk of being charged the dreaded cash advance fee.

*It is possible to manufacture spend with American Express gift cards. If you’re interested in this angle see this post.

**If you spend your day selling two dollar gum packs and three dollar bags of chips, a single credit card purchase of $2500 worth of gift cards is quite eye-catching, which is in and of itself suspicious. Furthermore some criminal types do use gift cards for actual money laundering.

***It is always a good idea to Google a new gift card before purchasing it. Flyertalk and blogs will often have useful information about the card in question. And a simple smart phone search while in the store can save you a lot of hassle later.

Please share your questions and gift card insights below in the comments section….

7 Responses to “Stamping Your Visa”