If you’re looking for a North star to guide you on your investing journey, you could do a lot worse than to set your course by John Bogle.

If the prevailing ethic that guides Wall Street is to “sell the sizzle and not the steak,” meaning to appeal to people’s fears and greed to sell them imperfect investment products that enrich you (the salesman,) then Bogle was just an old-fashioned butcher. He sold steak, and a lots of it.

Jack Bogle: No sizzle, just steak

And if after all the evidence is in, we have a tendency these days to look down our noses at active investment strategies and actively managed mutual funds knowing that the odds are firmly stacked against them, we have only John Bogle to thank for this smug feeling of superiority. After all he invented the first index fund sold directly to the public. And from that point on he argued ceaselessly against the slick voices of Wall Street that indexing was the smart money choice. (A point of view which is increasingly becoming adopted by a large proportion of institutional investors.)

He then spent his career building a gigantic brokerage out of the rarest materials on Wall Street: good character and stewardship.

His investment house (Vanguard) now sells index funds for almost every corner of the market. And they are consistently among the least expensive, and the most true to their indices in their respective classes.

Vanguard is investor owned so profits are funneled back into the mutual funds themselves which undoubtedly helps to keep the costs down.

But the point of this post is not to lionize this great man, or his investment house, it is to take a look at this interesting article that he wrote.

Now if you want me to just summarize this article because you don’t have the patience go through the effort of reading it in its entirety, that’s your loss.

But who am I to hold back?

(I’ll even admit that the essay is a little bit dry. But then, isn’t good character always little bit boring?)

The good people sleep much better at night than the bad people. Of course, the bad people enjoy the waking hours much more. -Woody Allen

In any case, the key theme in this essay is that of the pervasiveness of “reversion to the mean” within markets.

This simple concept essentially states that in small sample sizes improbable events can occur, but in large series improbable outcomes become more and more improbable. So the the more improbable the current statistical imbalance, the more likely its future correction.

To use a coin flipping analogy, if you flip a coin five times it’s quite possible you will end up with five heads or five tails. But if you flip a coin 1 million times, and the coin truly has an even chance of landing heads or tails, you will almost always end up with 50% heads and 50% tails.

To tell this story with Equity markets, Bogle shares with us two charts for a variety of different investment classes. And the pattern is fairly consistent.

Since I have a bias towards value investing I will reproduce his charts on large cup value versus large cap growth stocks.

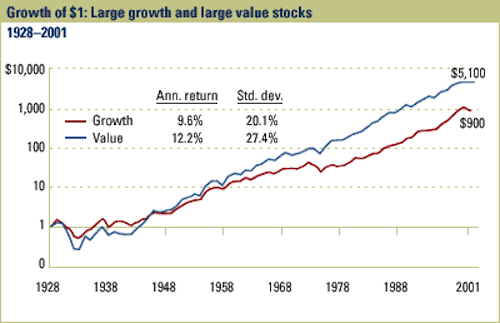

The first chart that he shows is one that looks like this:

This chart shows the value of one dollar invested in 1928 over time.

And the outperformance of the value investment appears consistent and convincing.

It is worth pointing out that the scale on the left is logarithmic which under plays The visual drama of this outperformance of value stocks. (Even butchers have a little sizzle up their sleeve sometimes, eh John?)

This chart nonetheless shows that one dollar invested in large-cap value funds grew to $5100 versus only $900 for the same dollar invested in large cup growth funds.

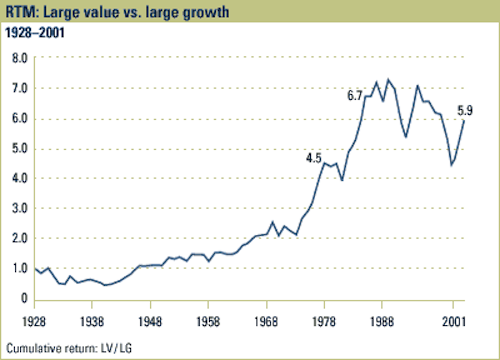

But then Bogle does something clever. He shows us his “telltale chart.” This clever graph displays the returns of value funds divided by the returns of growth funds. So if the line is sloping upwards value funds are outperforming growth funds, and if the line is sloping downwards growth funds are out performing value funds:

And Bogle displays the returns in this manner for the following reasons:

- We can now see the long periods of value fund underperformance hidden in the first chart.(Look for example at the period from 1928-1940 or 1988-2001.)

- We can see how dependent overall outperformance is on short periods of massive outperformance.(Look for example for the period from 1975 to about 1988- value ruled!)

- We get a visual representation of the up and then down repetition of reversion to the mean. (Which reminds us that if something has done relatively well of late, it’s likely to do relatively poorly in the future.)

And he even piles on little bit, justifying his own “buy the haystack” approach to index investing by casting doubt on the validity of the value premium in real world investing by pointing out:

- That real world value funds underperformed their indices, while real world growth funds overperformed their indices.

- That the fact that today’s value companies can become tomorrow’s growth companies, and vice versa, adds real cost to owning a pure value, or growth index.

But as a believer in the value premium, I see “the telltale chart” a little differently.

- Despite the zigzagging, and periods of underperformance, there’s a consistent upward slope to the telltale chart.

- There are no thirty-year or longer periods of underperformance for value funds, so if you’re long-term investor, to date, the value premium holds.

But these disagreements are small And I would never argue against someone owning a simple and cheap market portfolio. It’s hard to bet against a portfolio that is simple, market matching, and inexpensive.

And if we accept this idea of reversion to the mean, I think there are some interesting and uncontroversial implications.

- No matter what type of portfolio you end up choosing, the real key is sticking with it through thick and thin. (So choose one that’s true to your gut.)

- If you are stuck in a prolonged downward zag where your portfolio is underperforming the market, the only way for this to really hurt you long term is for you to jump ship and switch your philosophies midstream. If you do this, you’ll miss out on the rebound, and lock in your losses.

- The benefits of diversification are simple and well proven. But in practice owning a well diversified portfolio means that you will always own some underperforming dogs on your books. Just remember that because of the probability of reversion to the mean, today’s smelly curs are likely to be tomorrow’s sparkly unicorns.

What are your thoughts on reversion to mean? Do you buy it? And if so, what wisdom do you derive from it? I look forward to your comments.

2 Responses to “Mean Streets”