One of the main challenges of managing an investment portfolio is organization.

If you’re an average investor you likely won’t have just one 401(k) account. You’ll have a collection of accounts from prior jobs. Maybe you’ll also have invested in an IRA along the way. Perhaps a personal investment account has been thrown in there for good measure at some point.

You will likely have more than one brokerage account that your investments reside in as well.

One of the central tenants of portfolio management is that you should pay attention to your portfolio as a whole.

It is not so important how any one investment (or even investment account) performs. What is more important is how the portfolio as a whole performs and that your portfolio stays balanced. This preserves an appropriate level of risk exposure, and maintains an asset allocation mix that is in keeping with your original investment plan.

What is even more important, in my view, is keeping your costs down. Keeping an eye on this prize can mean a substantial difference in the size of your eventual nest egg, and thus the size of your income in retirement. But again, having all of your accounts spread out makes keeping track of costs difficult.

Fortunately, there is a marvelous, and free service that allows you to organize your investments.

It is www.personalcapital.com.

This is a beautiful website that aggregates all of your investments and organizes them for you.

The way it works is that the user supplies the website with his own username and passwords for his investment accounts.

Personal capital then harvests the account information on an ongoing basis and organizes it in one central location.

One can also submit credit card information and bank account information and personal capital will organize the user’s spending in a similar manner to The Mint application. This can be useful for budgeting.

This is an app that I use on a daily basis to track how my entire portfolio is doing as a whole.

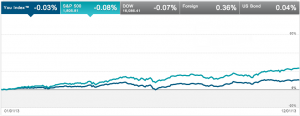

It actually aggregates all of my investment accounts and displays a “you index” which can be compared to other benchmarks.

The Me Index: Not as good as the S and P 500 this year!

(Click to enlarge)

Where I think personal capital really shines however, is in giving the investor an overall picture of his asset allocation, and in clearly displaying expense ratios for each fund he is currently invested in.

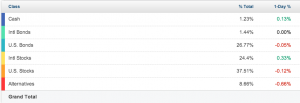

Here is a screenshot of my asset allocation.

(Click to enlarge)

My goal is to be 70% invested in stocks, and 30% in bonds (or cash equivalents.) So looking at this I can see that my overall risk exposure is pretty consistent with my original investment goal.

I can also go line by line through each investment class and make sure that no individual class is too underweight or overweight in my portfolio.

This is very useful come rebalancing time.

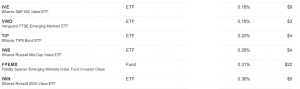

And here is Personal Capital’s display of my 5 most expensive funds’ expense ratios (as well as the yearly cost in dollars).

(Click to enlarge)

This is actionable intelligence. Although my expense ratios are in good shape now, when I first loaded my information into Personal Capital I found two funds that were too expensive (> 0.75% ER). This spurred me to find alternatives within my 403B account and get out of my expensive positions and into cheaper ones.

So what are the downsides of personalcapital.com?

I think there are two.

The first is the classic devil’s bargain of the Internet age.

In order to make use of this software you must divulge your usernames and passwords for your investment accounts.

Privacy and security issues abound.

This is a big deal to some, and not to others. You’ll have to decide for yourself whether you place a higher value on your privacy, or convenience.

It’s fairly obvious where I stand.

The second point of concern, is that Personal Capital is not just a nifty website. It is also a fee only financial advisor service.

So know that if you sign up for Personal Capital, you will likely be contacted with an offer for personal capital to help you to manage your money.

You will have to decide for yourself whether or not you are interested in their services.

For what it’s worth, I still manage my own money for a couple of reasons.

The first is that costs matter, and they matter a lot.

And the second is that managing my own investments is a hell of a lot of fun!

Disclosure: I received no compensation for this review from Personal Capital, and have no financial relationship of any kind with this company.