Smart investing is boring, plain-vanilla, milquetoast.

One need only invest in well diversified portfolio of low-cost, passive index stock funds, and just enough bonds to match their own risk tolerance. (And rebalance once every year or two.)

And yet here I am several hundred posts into my blog, still writing about investing.

And the reason for this is not complicated: Keeping it simple is anything but easy. (Which makes it interesting.)

Having spent a fair bit of time in Japan, I think of this paradox as a visual metaphor.

This is a garden at a Zen temple in Kyoto named Daitokuji.

Daitokuji

The picture doesn’t really do it justice. But it is indescribably beautiful and still in person.

And what is it? A few big boulders carefully placed among thousands of small pebbles, the odd tree, and some careful raking.

There’s no topiary. There’s no ornate sculpture. There’s no careful selection of flowering bushes geometrically pruned to perfection. There’s no trellis work.

It evokes nature. And the only hint of man’s intervention is the careful raking of the pebbles, which brings to mind fleeting ripples in a pond. More nature.

It is simple.

But it is anything but easy.

Great care has been taken to include only that which is necessary and exclude all clutter and distraction. Constant vigilance was required to avoid the unnecessary. Which is why this garden is such a rare and beautiful thing.

In fact, if you try to replicate this inspiring beauty when you get back home to Topeka, you’re likely to end up with something like this.

What my zen rock garden would look like…

Which is hardly inspiring.

And you get where I’m going with this don’t you? Daitokuji is passive investing a la John Bogle. Low-cost passive funds in proportion to the capital weighting of the whole economy and nothing else.

There’s no tilting. There’s no stockpicking. There’s no chasing dividends. There’s no momentum.

But you’re probably not as disciplined as John Bogle is, and neither am I.

So I find myself constantly tempted by the siren song of the next great angle. And my actual portfolio has a fair bit of tilting towards the value and size factors. I have even admitted guiltily to including a bit of tactical asset allocation in my investment plan.

But what can I say? I find this stuff incredibly interesting, and I just can’t stop myself from reading and thinking about it.

My desire to tinker is incompatible with my desire to keep my portfolio simple. So I’ve had to develop coping strategies.

Here’s a recent example.

Last week I came across this video of a Google talk given by Meb Faber on investing strategy. If you are an investing nerd like me, click on the hyperlink and watch it! It’s quite interesting. (If you’re not an investing nerd, don’t torture yourself, I’ll summarize some of the more salient points raised in it below.)

The high points of this talk for me were:

- The importance of international diversification.

- The perils of “home country bias.”

- A strategy for using international CAPE ratios to tilt your portfolio towards undervalued international countries.

- The foolishness of pursuing a dividend strategy in the current low interest rate environment (when they have never been more overvalued.)

- A strategy for leveraging the expertise of hedge fund stock pickers (like Warren Buffett) to create “clone portfolios.”

The first thing I must acknowledge is that all of these points (with the possible exception of the last one) were immediately interesting to me because of the presence of my own confirmation bias.

In other words, the core message of Faber’s talk spoke to my previously held beliefs about international diversification and value investing. And the fact that his views on investing seemed to jibe so well with my own, made even the “clone portfolio” idea quite interesting to me.

Which is to say that watching this video was extremely dangerous to my stated goal of keeping my portfolio nice and simple.

But what was a poor sap like me to do in such a situation?

I thought were really two options.

1. Exert an iron like will and do nothing.

Or

2. Satisfy my curiosity by playing around with simulated portfolios.

And since I lack an “iron like will” I went with option B.

I changed exactly none of my positions in my actual portfolio. But I did create five new model portfolios on motifinvesting.com which I will follow prospectively, with interest, into the foreseeable future.

(These new portfolios include four “clone portfolios”, and a global value portfolio.)

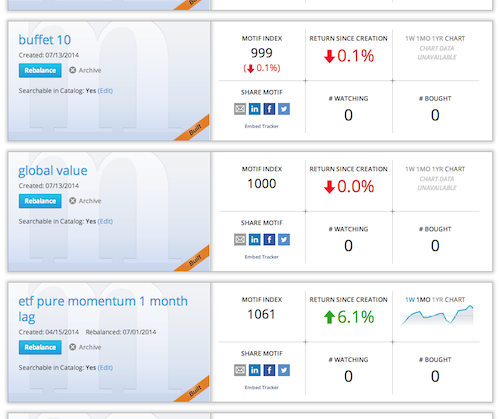

And this is not the first time that I’ve done this. In fact I now have something like 18 motifs and this is what my homepage looks like at motifinvesting.com.

3 of my newer motifs…

And aside from The obvious entertainment value, I learn something from following these portfolios over time. I learn how these allocation approaches behave in different market conditions. I also learn which of my investing interests persist over time, and which of them are merely passing fancies.

Best of all this strategy is free. Both in terms of what it costs me to execute it, and in terms of what it costs me to avoid unwisely changing my investment strategy.

And I don’t actually believe that this strategy is completely futile.

I believe that by continually feeding my own curiosity I also gain actionable morsels of information over time.

Two pearls that I learned from this exercise that I may make use of in the future are

- The existence of Faber’s GVAL ETF which focuses on investing in value companies in value countries. (This ETF may very well have a place in the international portion of my portfolio in the near future.)

- The fact that I can use GVAL to see which 10 companies Faber believes the most undervalued in the current world economy based on quantitative measures of global International CAPE ratios and momentum.

So even though my actual portfolio changes very little over time, my urge to tinker is constantly satisfied, and my desire to learn more about investing theory is continually reinforced.

Which is kind of a “win/win” in my book.

What is your strategy for keeping it simple with your investments? Share your comments below…

10 Responses to “Diversions”