One of my friends is pretty into the miles game. Credit card churns, manufactured spending, planning trips, he’s all in.

In our conversations he’s confided in me that his wife (aka “Mrs. skeptic”) is not a such fan of the miles game. She remains dubious.

So I thought it would be interesting to have a conversation with her about the miles game. She kindly agree to discuss the ethics of travel hacking with me…

MD2: So tell me briefly about your thoughts on the miles game.

Mrs. Skeptic: I guess the first thing is that it seems dishonest.

I understand that credit card companies offer sign up bonuses to people in the hopes that they will sign up and put money on the card.

What doesn’t seem right to me is churning multiple cards and manufactured spending.

MD2: So lets discuss manufactured spending, why don’t you feel comfortable with that strategy?

Mrs. Skeptic: It just doesn’t pass the sniff test.

When I hear people talk about it, or when I read about it on line, I always hear things like “it’s us versus them, or “it’s the little guy versus the big guy, or “the credit card companies are exploiting people, it’s only right we exploit them. ”

So to me it sounds like a conspiracy.

The other thing is that the only people who really understand the mechanics of the miles game are the people who play it.

It’s complicated. You use your credit card to buy gift cards and then you load them onto a bluebird cards and then you pay utility bills or credit card bills. If this is a legitimate way of doing business then why is it so secretive and complex?

It seems like miles game players are just gaming in the system not engaging in legitimate activity.

MD2: I’d like to follow up on this idea that manufactured spending is harmful.

Let’s imagine that I go to Rite Aid and buy $1000 of Visa gift cards for $1010. I later go to Walmart and load them onto my bluebird card, and then I pay for bills from the bluebird account. Who is being hurt in this scenario?

Mrs. Skeptic: No one’s really being hurt. Everyone’s being paid. The credit card company is paid for the transaction, Rite Aid is paid for selling the card, The bluebird card is being used as directed.

But, for example, in my job I accept checks and not cash. I would never feel comfortable telling someone to go and buy gift cards with a credit card and then write me a bluebird check. Its not a normal way of doing business.

It also seems like people who are playing the Miles Game might ruin the bluebird card for people who are using it legitimately because they cannot get into a real bank account.

It’s so complicated. And none of these companies are suggesting that you should use their products in that way.

I mean when you describe the process, it sounds awful lot like money-laundering.

MD2: That’s a good point about jeopardizing the bluebird card for the under banked. But if each step in the process is legal and you’re not trying to hide ill gotten gains I’m not sure that I can see how it is like money laundering. After all it is the creditor that writes the contract, and the contract is in no way being broken.

So Let me ask you you think about services like Charge Smart that allow you to pay for bills using your credit card online and charge say a 3% fee for doing this. Is that dishonest?

Mrs. Skeptic: That doesn’t seem dishonest because you’re using the service as it’s meant to be used and everyone’s being paid.

MD2: I would argue that the miles game is ethically identical to a service like Charge Smart. After all you’re still paying a small fee (1% in this case.) And in exchange for paying the smaller see you agree to incur the risk and perform the labor of transforming credit into a vehicle that can pay bills (bluebird).

But please tell me a little bit about your concerns about applying for multiple cards?

Mrs. Skeptic: I have a few concerns.

First of all I know that hard credit inquiries hurt your credit score. As someone who works in the financial industry I know how important a credit score can be.

My second concern is that there are a lot of opportunities for mistakes when you open a bunch of credit cards. These mistakes can negatively impact the credit score and your life.

I also don’t like the idea of applying for business cards, when you don’t have an actual business that makes money. That seems very dishonest to me.

Finally the whole idea of applying for multiple cards every three to six months just seems so outside of the bounds of normal behavior. It seems abusive. I mean, I think I would be ashamed to discuss doing this with my parents.

I was raised to believe that a handshake was your word. That you shouldn’t buy things you can’t afford.

I don’t want to do anything that I can’t openly discuss with all of my friends and family.

The other thing is, it seems like once you start doing this stuff, you might get more comfortable doing other things that are not within the norms of society.

I can just imagine a scenario where you try to describe this stuff in court, and to me it just sounds very suspicious.

MD2: So let me drill down on this credit score issue. While it is true that hard credit pulls can drop your credit score 2 to 5 points, were you aware that increasing credit lines can actually improve your credit utilization ratio (a bigger factor in your credit score?

The end result is that you have a temporary hit on your credit score that usually resolves within a month or two. (The credit inquiries actually fall off your report after two years.)

This is why the common wisdom of the miles game is not to play it if you have a big loan application coming up in the next year or two.

What are your reactions to this information?

Mrs. Skeptic: I wasn’t aware of that. But that certainly is reassuring.

One thing I will say though is that if I did see a bunch of credit card applications on applicants credit report in my job it would certainly prompt me to ask more questions.

MD2: I’d like to give you my take on the ethics of the miles game and get your critique.

I always try to obey two simple rules. The first is that I don’t lie in order to achieve a goal in the miles game. So all my applications are filled out truthfully, and I don’t lie in conversations with customer service agents. The second rule that I try to obey is that I try never to hurt anyone. So for instance I would never buy something with the intention of returning it because that hurts the retailer.

I have a bunch of other sub-rules, like I don’t manufacture more spend in a month than the amount of money that I make but these rules all kind of fall under my two big rules of honesty and not hurting anyone. My feeling is that it is reasonable for me to put all of my spending on credit cards as long as I play by the above rules.

Do you have any thoughts about the flaws in my thinking?

Mrs. Skeptic: I think that sounds pretty reasonable.

But I would just point out that your blog is all about all things financial. And when you spend so much time focusing on the miles game you seem to be condoning this as this smart financial move. I’m not sure that that’s really true.

MD2: so what are the risks financially from your perspective?

Mrs. Skeptic: Well, aside from the credit score risk, what would you do if all of these manufactured spending techniques stopped working. Wouldn’t you be stuck?

MD2: I wouldn’t say I’d really be stuck. The only thing that I would stand to lose would be the unmet sign up bonuses if I couldn’t meet my spending requirements.

But there are some risks associated with manufactured spending, I will admit.

If I bought a bunch of gift cards and the next day bluebird stopped working that I would have to liquidate those gift cards by another means.

I always say you should not manufacture spend in amounts that you cannot afford to be without for a month or two because sometimes things go wrong and it may take a little while to get your money back.

But as long as you don’t do something stupid like lose your gift cards, and you’re honest I don’t see much risk of losing a lot of money.

I really want to thank you for talking to me. I’ve learned a lot from your perspective. And I think it’s a very valid one.

My take-home message from talking to you is that it probably would not be a good idea for you to do the miles game because it just doesn’t fit with your own sense of what is right and what is wrong. Living outside of your moral comfort zone is never a good idea. I don’t discount that your views may evolve in the future though, (as may mine.)

For me on the other hand I do feel that I can play the miles game without betraying any of my core values or taking undue risk. So in my case its a winning proposition at this point.

Mrs. Skeptic: I enjoyed talking to you too. I Actually feel a little bit better about my husband playing the miles game after speaking with you.

MD2: I hope we’ll have the opportunity to talk again. Thank you.

Note: If you’re interested in the credit score angle please see this post.

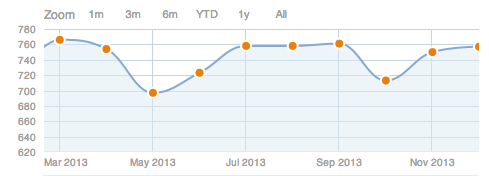

And here is my most recent credit score graph from creditkarma.com. This is a real world view of the effect of two 6-7 card churns on a credit score.