Spending and saving are not mutually exclusive.

We all spend money, and most of us save it too.

I, for one, do not believe in some Platonic ratio of saving to spending.

If there were such a ratio, (say a perfect 65% savings rate,) then it would be easy to tell someone if they were over-saving or under-saving.

But to imagine a perfect saving ratio, is to imagine homogenous race of human beings with identical values, resources, dreams, and needs.

What a ridiculous premise.

It is trite to say that we are all different and have different needs and different values. But, as far as I can see, it also happens to be true.

In fact, the older I get, the more I am attracted to that once dirty word, “relativism.”

I remember as a college student, there was this fundamentalist preacher would drive his Astrovan to our commons in sunny La Jolla and accuse everyone walking by of being sinners or fornicators. (At the time my chief regret was that I was not more guilty of the latter.)

He wore an ill fitting tan polyester suit, a short sleeve button-down shirt with armpit stains and a thick, course burlap looking tie. He had thick engineers glasses and a severe side part.

He would pronounce words like “hell” as if they had two syllables… as in “you’re going to Haaaayyyulllll, fornicatorrrrr!”

He was quite honestly, like a creature from Mars Who had landed and had promptly begun haranguing the passing surfers, and frat boys, and coop hippies.

But I remember a point that he made that was quite interesting to me at the time. Essentially, “if you don’t believe in an absolute God derived truth, on what grounds can you judge anything to be evil, or sinful, or wrong?”

As a kid who grew up hearing stories of my grandparents fleeing the Holocaust, I was pretty attached to this idea of absolute evil. So this argument really resonated with me.

But even then, I could see how backwards this logic was. After all it required accepting without evidence an almighty being just because it satisfied our our own small impulse to judge.

Now this argument seems not only logically unsound, but it feels wrong to me too.

Each day, I am more aware of my own irrationality, and the dependence of my judgment and behavior on external factors like how much I slept, or the moods of people around me, or what I’ve eaten, or what season it is.

And this increasing sensitivity to the fallibility of my own judgment, has paradoxically opened my mind up to the possibility of change. If sleeping more makes me a kinder person, then couldn’t there be a way for me to structure my life to ensure that I get more sleep? If I am motivated by the drive for pleasure, then isn’t there a way for me to align my pleasure seeking tendencies with some forward progress towards a goal?

This point of view sees decision-making more as the expression of a complex equilibrium, than as the exercise of binary moral choice.

Which is to say, at this point in my life, I’m pretty relativistic.

(Unless your name is Richard Sherman, and you cheated and got away with it, then caused the 49ers not to get to the Super Bowl, and then blabbed your big fat mouth about how great you were and how lame your opponent ((Who happens to have a great set of hands)) was to a sideline reporter. That is just evil. Pure evil)

And from his cavernous nostrils shall come sulphuric jets of hellfire….

But I digress. The point of all this is just to say that as far as I can see, there is no such thing as absolute over-saving or under-saving. There can certainly be saving too little to reach a specific financial goal. And there can be saving too much, If by saving you are robbing yourself of happiness.

But this is very difficult to judge even for oneself, let alone for someone else.

So why not be empirical about it? Why not start cutting down our own spending, until we reach a point where our happiness is negatively affected, and then spend just a little bit more than that?

My sense is that culturally we are constantly bombarded with messages to consume more, so it seems logical for us to turn our focuses inwards. Why not simply evaluate our happiness relative to the changing variable of our own decreasing spending?

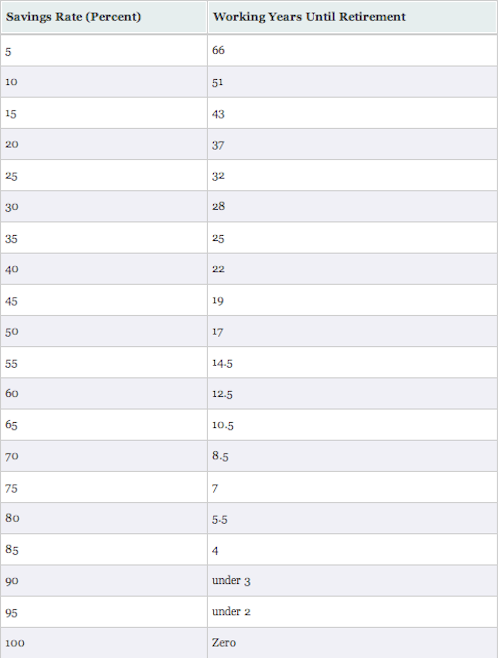

Which is maybe why this table (the one that got me going on all this early retirement stuff in the first place) was so impressive to me when I first happened upon it last year. (on Mr. Money Mustache)

It doesn’t say “you save too much” or “you save too little.” It’s simply points out that the percentage of your take home income that you save (and spend) has a measurable impact on how far you are away temporally from financial independence- (or the point at which employment becomes a purely voluntary act.)

It is logical, and nonjudgmental, and it frames financial choices in a tangible way that has effortlessly bent the trajectory of my own spending towards more saving.

And unexpectedly, it has seemingly bent the trajectory of my life towards more happiness.

So perhaps I’ll keep this experiment going for just a little while longer yet…

11 Responses to “An Embarrassment of Riches”