Things can get pretty crazy when it comes to beliefs.

It seems to me that when you’re devoted to a certain philosophy it’s very hard not to develop a series of blind spots.

When a belief system really resonates with you it sort of becomes a part of you, so any challenge to the philosophy, or any idea that is in conflict with the philosophy, can feel like a personal attack or a threat.

And the only thing more fierce than a single person who believes something deeply, is a group of people who believe something deeply.

Groups of like-minded individuals tend to develop a drive towards orthodoxy. There can become an “us versus them” mentality. And often times there can even be a competition amongst the believers themselves to see who is the most devoted to the common philosophy.

And I’m no different. I have plenty of tribal instincts. I usually believe that my way is the best way. And I can’t help but feel that my own emotionally satisfying ideas are somehow rational.

And in a world where people have beliefs and these beliefs come into conflict with other people’s beliefs, be they religious, economic, political, or otherwise, avoiding conflict can be quite difficult.

I recently came across this phenomenon in an unexpected place. The Mr. Money Mustache forum.

Anyone who has read this blog for any period of time knows that I’m huge Mr. Money Mustache fan. His blog literally changed my life and changed it for the better.

So one would think that posting on a topic there, would be a pretty stress-free exercise for me. After all that forum is composed of like-minded individuals who are interested in frugal living, low-cost investing, and early retirement. As you may have noticed these are all subjects dear to my heart.

Be that as it may, in conflict is exactly where I found myself.

You see, I decided to give my two cents as to why I think Betterment is an excellent investment product, particularly for people who don’t want to manage their investments themselves.

And for this I was labeled a “shill,” a “variable annuity salesman,”and a poor and inane writer. And another writer who approved of Betterment, and disapproved of the name-calling was labeled a “complainy pants ” who contributed only “butt hurt” to the conversation.

Hilariously, one veteran poster claimed that the above labels were not ad hominem attacks.

Not so hilariously, when I responded in kind (I’m no angel), I alone was kicked off the forum for a week by a moderator who just one page earlier have been actively engaged in the argument from the “Betterment sucks” perspective.

Stay classy Mustache Police.

But honestly, this is all water under the bridge.

People of different beliefs will clash, and clash we did. Life goes on.

I think the interesting part is that the question remains. Does Betterment provide value?

The anti-Betterment folks had made the following argument:

- Even small fees like 0.15% to 0.35% of assets under management are corrosive to eventual portfolio value. (And in general I agree.)

- Betterment adds no value to your portfolio above what you could get from a simple fee free portfolio from Vanguard rebalanced once a year.

And the pro Betterment folks had made the argument that the Betterment fee of 0.15%-0.35% provides real value, and possibly even better returns by;

- Allowing you to purchase fractional shares so that when you invest $100 in the stock market, $100 will in fact be invested.

- Automatically rebalancing your portfolio each time you receive a dividend payment or an interest payment or make a new contribution.

- Providing you with a “set it and forget” multi asset class slice and dice portfolio with good international exposure, as well as exposure to the value and small size factors which have shown to increase returns per modern portfolio theory.

- Providing an extraordinarily user-friendly interface that is transparent and shows your fees as well as the money invested as well as your percentage return. (People routinely pay extra money for ease-of-use with their computers and smart phones, why would they not do the same for investment products? )

So essentially the anti-Betterment cadre argue that Bettement is all sizzle and no steak (flashy marketing as opposed to real value.)

While the pro Betterment posse argue that there is real value in a well-designed user interface, and that it is quite possible that a Betterment investor could outperform a simple vanguard portfolio investor due to the rebalancing dividend, the ability to have every dollar invested, and improved portfolio design.

And in the week that I was exiled from the Mr. Money Mustache forum I came up with an idea.

Instead of continuing the argument, why not just design a prospective experiment that we can all learn from.

Let’s see how much Betterment’s fees eat away at portfolio performance.

Let’s see if continual rebalancing pays real dividends.

Let’s see if being able to invest 100 cents of every dollar improves returns.

So what I propose to do is this:

In taxable accounts I will make the following investments.

I will invest $1000 in my Betterment account at an expense ratio 0.25%, in an 80% stock/20% bond portfolio.

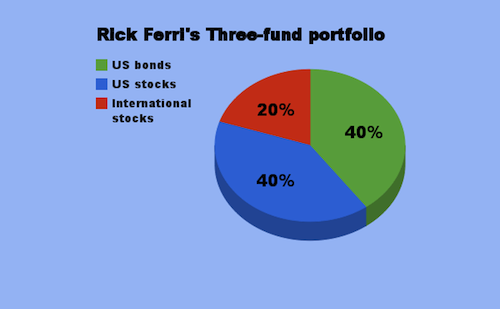

On the same day I will invest $1000 in a TD Ameritrade account using Free Vanguard ETFs to replicate a modified version of this lazy portfolio from Rick Ferri. (20 % bonds,40 % international stocks, 40 % US stocks)

US bond = BND, US stocks=VTI, International Stocks = VT

US bond = BND, US stocks=VTI, International Stocks = VT

I will rebalance the Vanguard portfolio once a year at the beginning of January.

And we can just follow the account values going forward to see which strategy outperforms which in various market conditions, how corrosive the fees are, and whether or not the Betterment portfolio does in fact provide increased returns after fees.

I have no idea how this experiment will turn out, but I’m fairly sure it will be interesting, and I can imagine either strategy winning.

But before I make my ETF purchases, I wanted to open up my study design for comments.

Do you think this is a well-designed experiment?

And what’s your best guess about the results of this experiment?

Please leave your comments below.

19 Responses to “A Little Experiment”